tax processing unit harris county

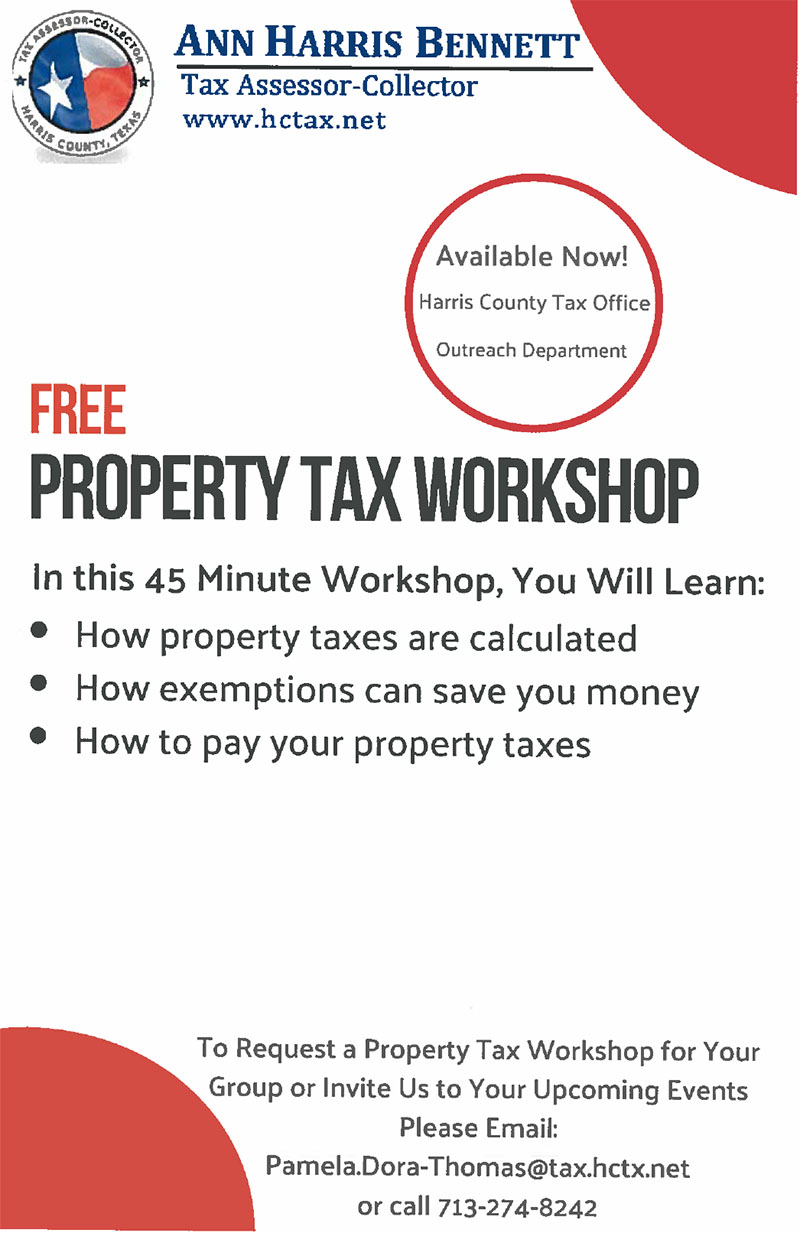

Ann Harris Bennett Harris County Tax Assessor-Collector P. 713-274-8197 Distribution Center Main Line Phone.

Property Taxes Due By Dec 20 2020 Harris County Georgia

The first thing you read is this.

. Harris County Appraisal District. HCAD is a political subdivision of the State of Texas established in 1980 for the. You can report possible scams to the Tax Department and IRS online or by phone.

If your question pertains to your Pennsylvania personal income tax return or a potential state tax liability. We will review your complaint promptly and if appropriate take corrective action. TOLL FREE1-800-250-5208 This letter will go on to state Distraint Warrant What is a Distraint Warrant.

Harris County Tax Assessor-Collector PO Box 4089 Houston TX 77210 Title Service Phone. TOLL FREE1-800-250-5208 This letter will go on to state Distraint Warrant. This County Tax Office works in partnership with our Vehicle Titles and Registration Division.

Department of housing urban development is the promotion and. The county will now have to cut back on department budgets and will not be allowed to appropriate new funding for things like law enforcement county health systems and. Tax Processing Unit Harris County.

Tax Processing Unit Erie County Public Judgment Records TOLL FREE1-800-258-0955. Embed Last week we received a letter that purported to be from the Tax Processing Unit Tarrant County Public Judgment Records The letter surprised us because. By an edhat reader.

Please CHECK COUNTY OFFICE availability prior to planning travel. Tax Processing Unit. 713-274-9700 Cypress Hill Distribution Center.

Tax May 20 2022 arnold. Then the words Distraint Warrant Youre probably. Harris County Tax Assessor-Collectors Office.

This week our client received a letter from the Tax Processing Unit Travis County Public Judgment Records The letter was addressed to our clients name and. Erie County Public. Revenue Communications Department The Department of Revenue recently received information that scam artists continue to target Pennsylvania taxpayers with a scam.

If you or a loved one has recieved a letter like this one you may be entitled to compensation as an ongoing complaint filed against the company American Tax and Disbarred Attorney Terrance. The Harris County Appraisal District known as HCAD assesses the value of all Harris County property. Tax Processing Unit Harris County.

An account may be billed for one or more of the taxing units shown below. ESTHER BUENTELLO FLORES RTA. For local property taxes contact your local taxing authority.

Each taxing unit has their own rates and allowed exemptions. Tax Processing Unit Erie County Public Judgment Records TOLL FREE1-800-258-0955.

Harris County Entities In Texas Save Nearly 20 Million In Tax Revenue With Identity Analytics

How To Get To Harris County Tax Office In Houston By Bus Or Light Rail

Harris County Tax Office Services East Aldine Management District

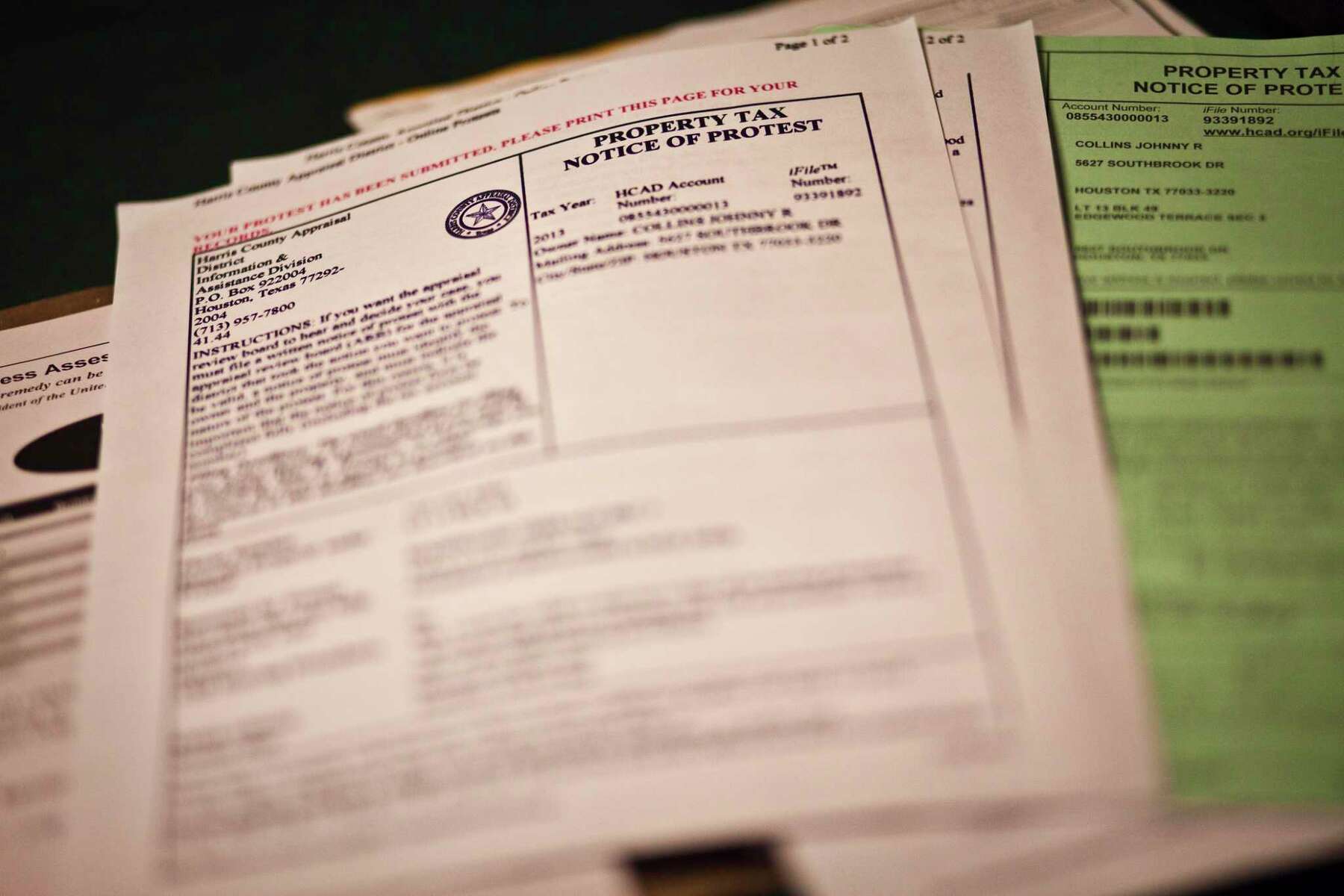

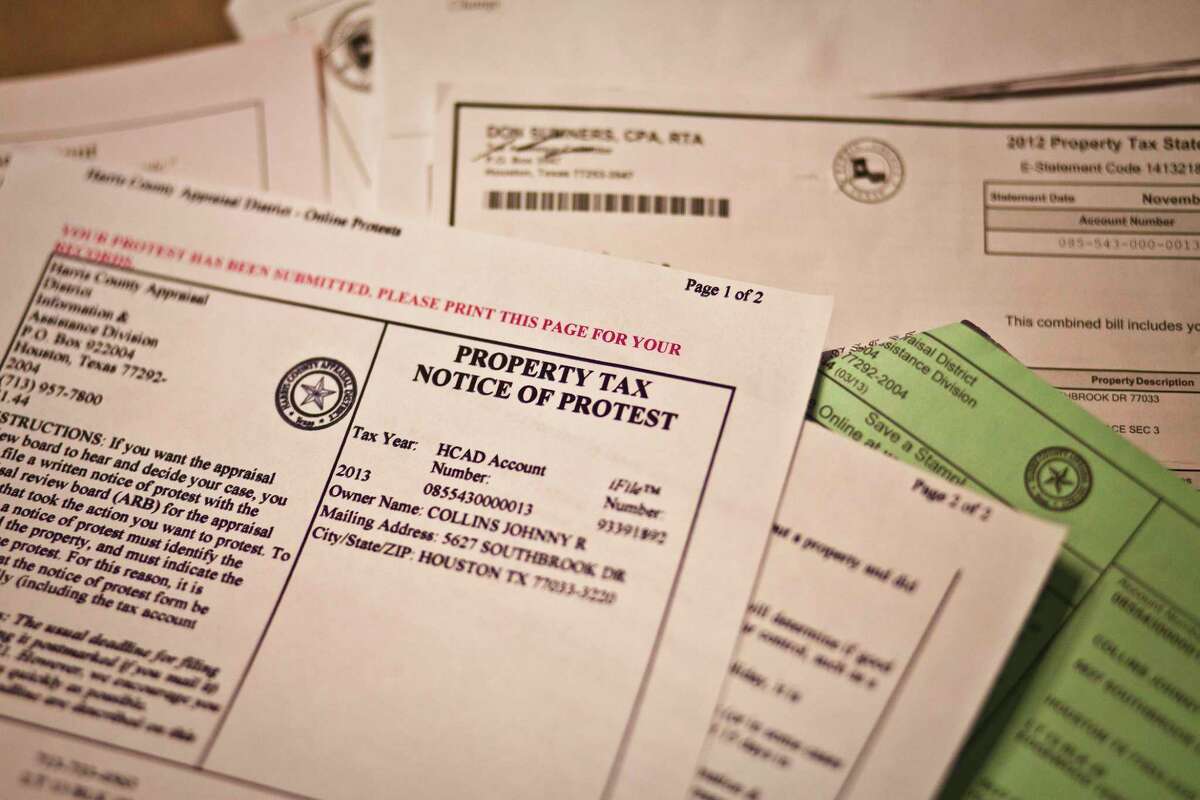

How To Prepare For Protesting Your Property Tax Appraisal

Harris County Moves To Influence Housing Tax Credit Applications

Harris County Texas Property Tax

Harris County Offers Break In Delinquent Property Tax Payments Khou Com

Harris County Tax Support Initiative Pumps Over 10 Million Into Local Economy Woodlands Online

Unemployment 10 200 Tax Break Some States Require Amended Returns

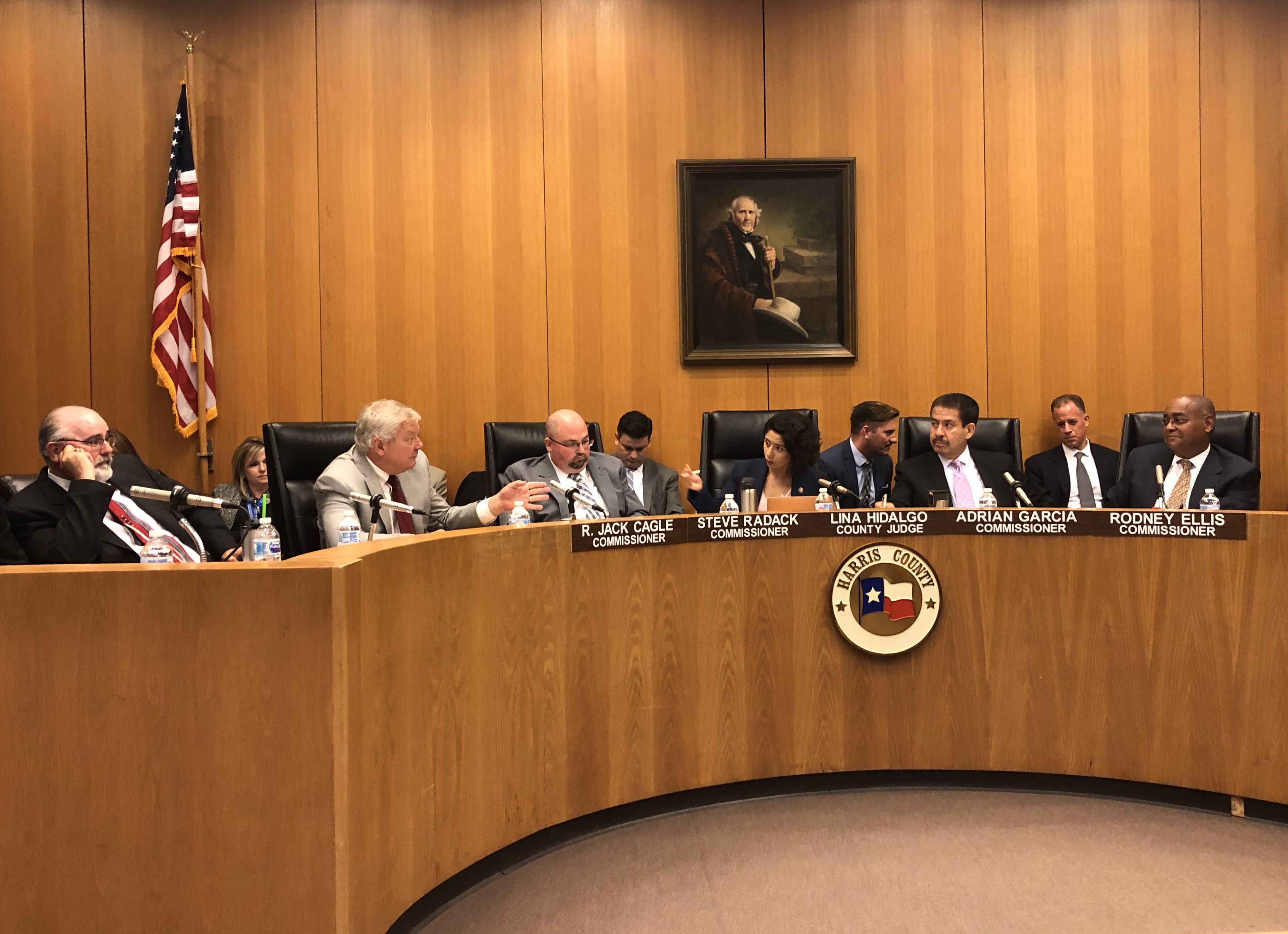

Republican Commissioners Reject Vague Compromise Proposal In Harris County Tax Increase Fight The Texan

Harris County Cuts Property Tax Rate By 2 Houston Public Media

Harris County Homeowners Should Expect A Big Spike In Value On Their New Property Appraisals

Property Tax Statements Mailed In Harris County Houston Tx Patch

Harris County Tax Office 1721 Pech Rd Houston Tx Government Mapquest

Plaintiffs Third Amended Petition For Taxes And Claim For City Of Houston Special Assessments February 26 2018 Trellis

Mayor Eric Johnson Has A Better Equity Plan

Harris County To Consider Disaster Declaration Loophole To Raise Property Tax Rate Above Sb 2 Limit The Texan

Harris County Commissioners Approve Higher Property Tax Exemption For Seniors Residents With Disabilities Community Impact