flow through entity canada

This means that the flow-through entity is responsible. For Canadian income tax purposes ULCs are treated as regular corporations subject to Canadian tax on their worldwide income.

Canada Health Act Annual Report 2020 2021 Canada Ca

Flow through entity canada.

. It is considered a separate entity for legal purposes in the US and Canada. That is the income of the entity is treated as the income of the investors or owners. A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests in shares of the capital.

Understanding What a Flow-Through Entity Is. However for US tax purposes ULCs may be considered. Downsides to Flow-Through Entities.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. In the United States certain business entities such as Limited Liability Companies LLC or subchapter S corporations are flow. Canadas quirky tax innovation.

This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain. Trade or business and dispositions of interests in partnerships engaged. Flow-through entities are considered to be pass-through entities.

A flow-through entity is a legal entity where income flows through to investors or owners. It is considered a flow through entity for tax purposes. In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities.

The Advantages of an S Corporation in Canada. The payees of payments other than income effectively connected with a US. The information in this section also applies if for the 1994 tax year you filed Form T664 Election to Report a Capital Gain on Property Owned at the.

Flow Through Entities Owned by Residents of Canada. However for US tax purposes ULCs may be. For Canadian income tax purposes ULCs are considered corporations and are subject to Canadian income taxation.

Flow-through shares have generated billions for mining exploration and contributed to the development of some of the.

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

Image Result For Example Of Accounting Cycle Accounting Cycle Learn Accounting Accounting Basics

Archived Tax Planning Using Private Corporations Canada Ca

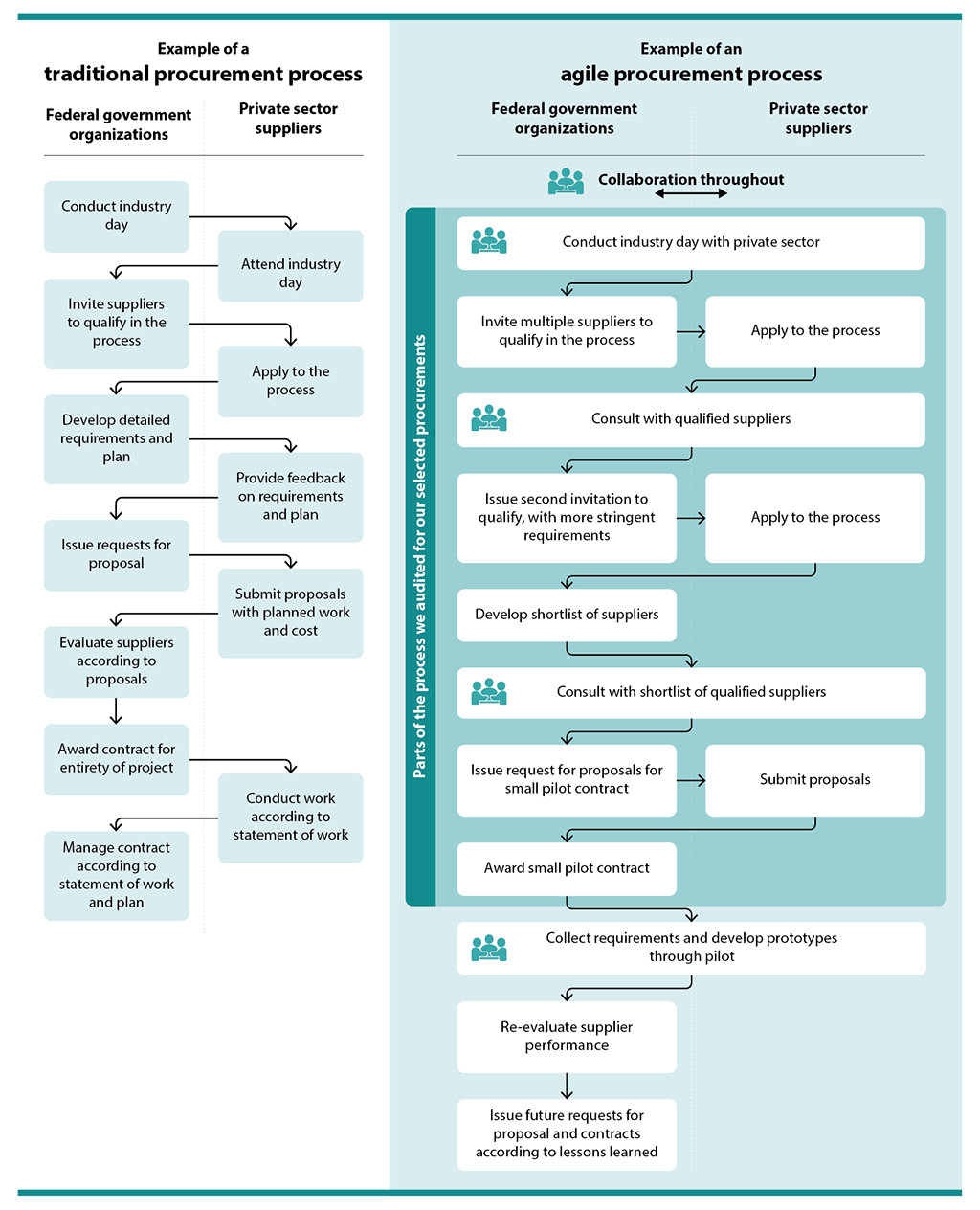

Report 1 Procuring Complex Information Technology Solutions

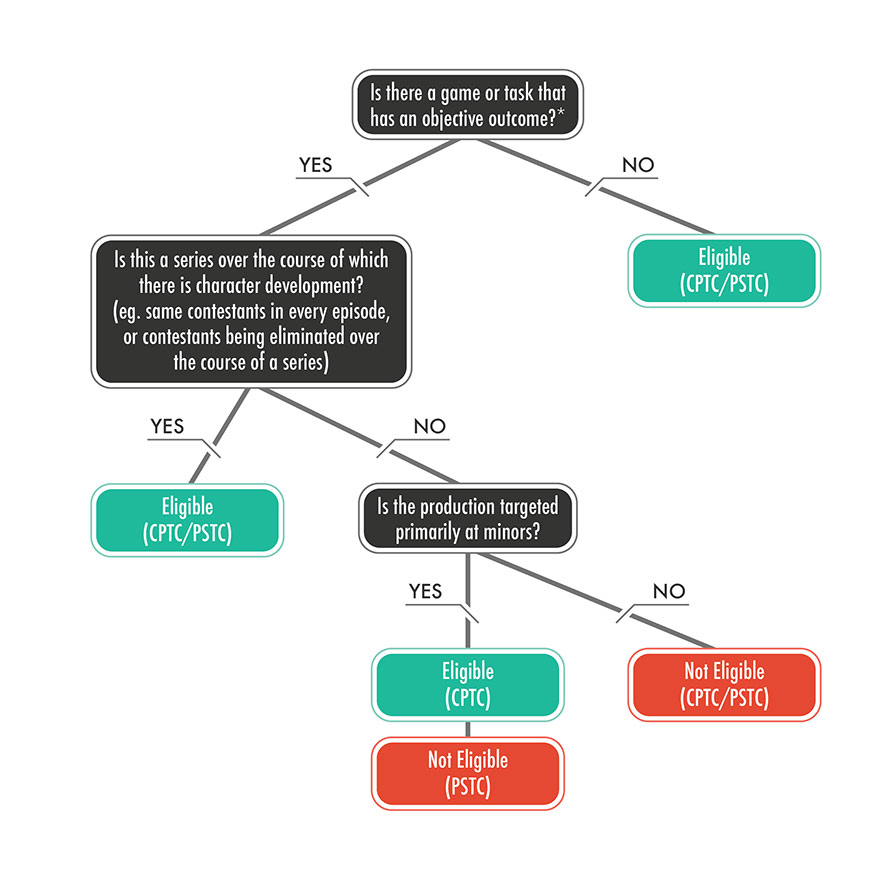

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

The Drug Review And Approval Process In Canada An Eguide Canada S Drug Health Product Regulatory Experts

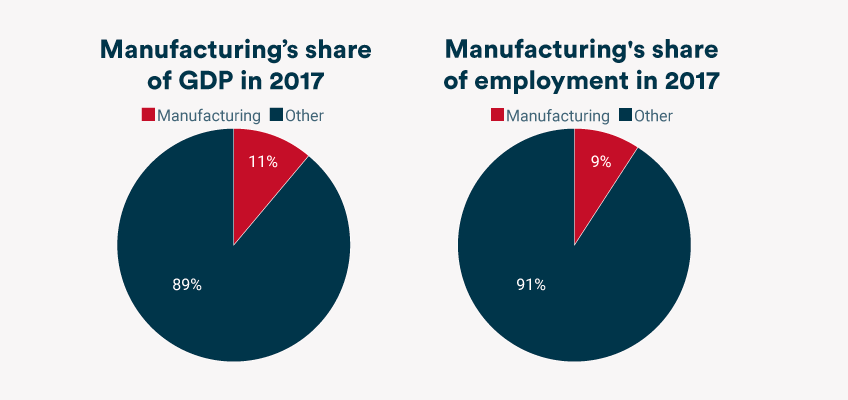

Profile Of Canada S Manufacturing Sector Bdc Ca Bdc Ca

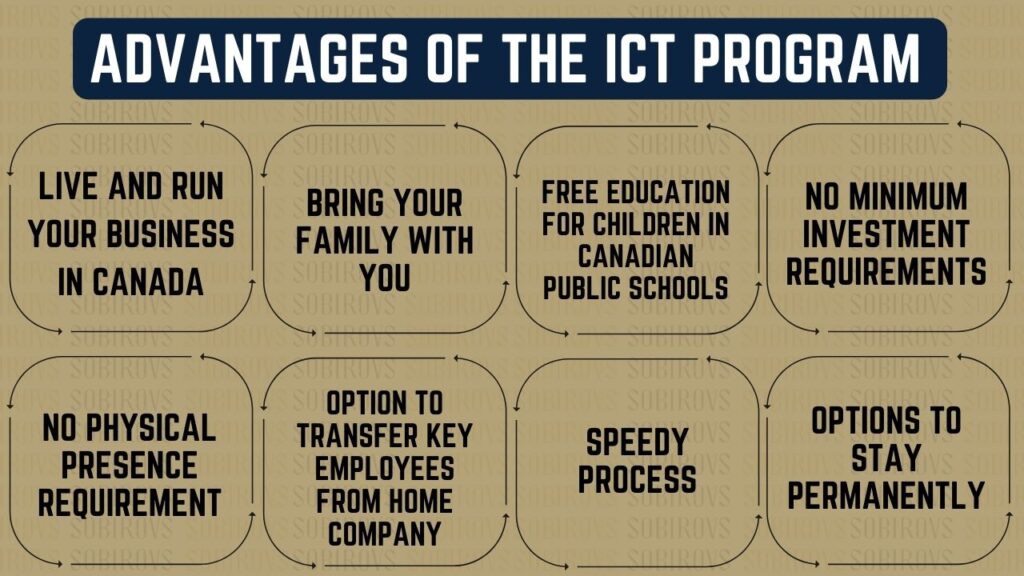

Intra Company Transfer Canada How To Expand Your Business To Canada

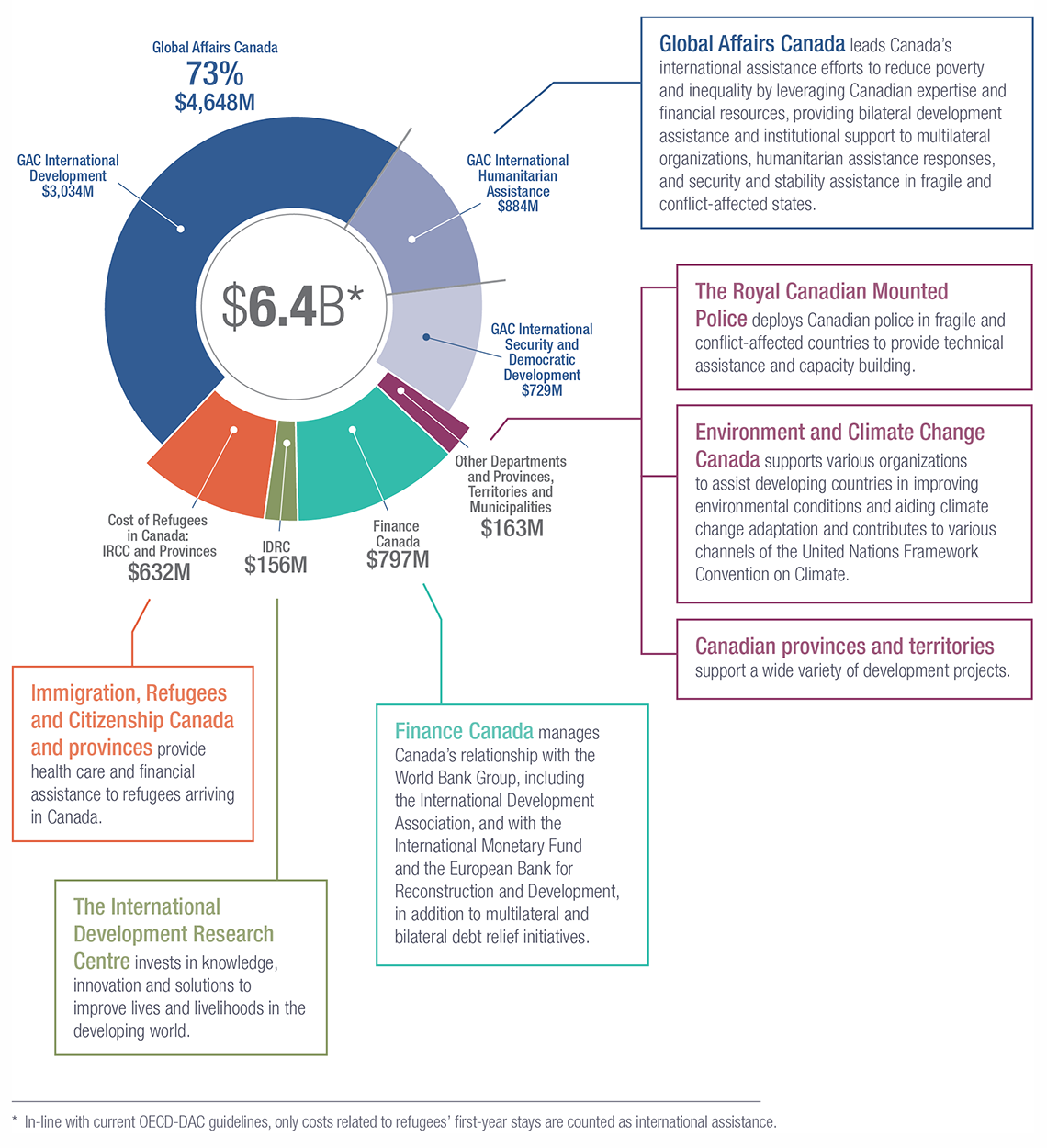

Statistical Report On International Assistance 2018 2019

Visualisation Of The Ocean Economy Human Impact Infographic Ocean Economy Global

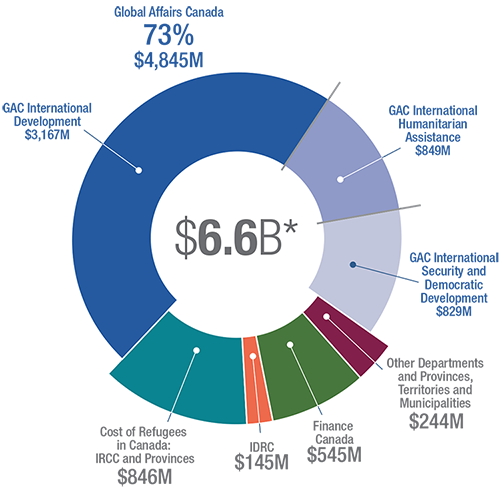

Statistical Report On International Assistance 2019 2020

Reit Taxation A Canadian Guide

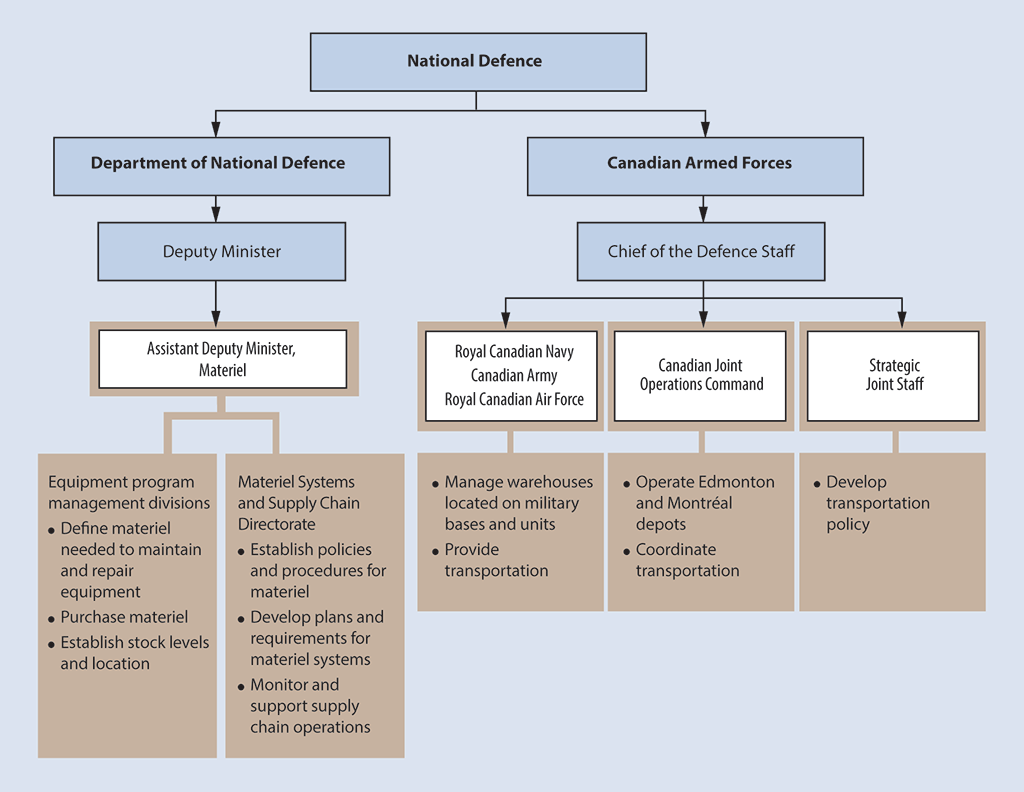

Report 3 Supplying The Canadian Armed Forces National Defence

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Canadian Women S Heart Health Alliance Atlas On The Epidemiology Diagnosis And Management Of Cardiovascular Disease In Women Chapter 5 Sex And Gender Unique Manifestations Of Cardiovascular Disease Cjc Open

Some Business Analysis Techniques Critical Success Factors Use Case Diagr Business Analysis Critical Success Factors Business Development Strategy